CRE Receivership: Protecting Tenant Interests

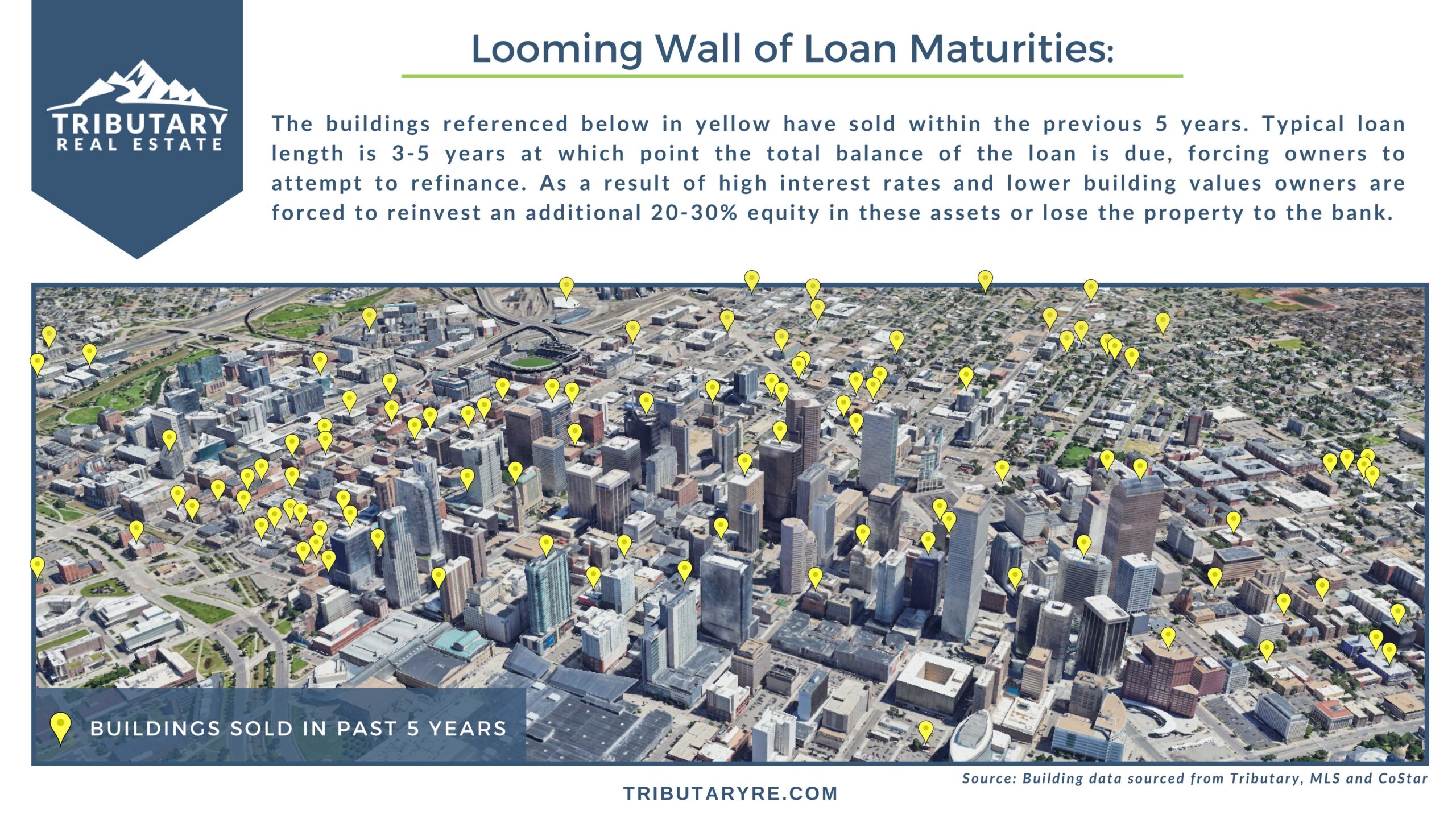

With persistent high interest rates and falling values in many urban commercial real estate asset types, the industry faces a major challenge in 2024 and years to come: a looming wall of hundreds of billions of dollars in loan maturities. This complex issue promises to have ripple effects far beyond the real estate industry and has the potential to impact the broader economy in a number of crucial ways.

The lack of robust capital markets transactions in the past twelve months in combination with lender flexibility in extending loan terms has culminated in a large concentration of modified loans – previously maturing in 2023, now set to mature in 2024 and beyond. Known as “extend and pretend,” this has pushed the amount of CRE mortgages maturing this year from $659 billion to $929 billion: a 40% increase.1

As this wall of maturities comes due, we can expect refinancing in some cases, but we should also anticipate many assets going into default and, consequently, receivership. This specter not only looms large over property owners, but tenants can often find themselves caught in the crossfire. Understanding the intricacies and potential impacts of receivership is crucial for both landlords and tenants alike.

Understanding Default: The Unraveling Process

In commercial real estate, a loan default occurs when property owners fail to meet loan obligations, often after a great deal of lender flexibility and attempts to reconcile (no one really wants to be in this position – banks aren’t in the business of being landlords). A default can stem from various factors, such as economic downturns, mismanagement or unexpected market fluctuations. If a borrower does default, many lenders turn to receivership as a next step and alternative to costly foreclosure proceedings. A court-appointed, third-party receiver is brought in to navigate the loan terms in an effort to best conserve asset value on behalf of both the lender and borrower.

The default process timeline involves filing a legal dispute and seeking out a qualified receiver who is ultimately agreed upon and appointed through the court. The length of a receivership can range from months to years depending on the complexity and size of the real estate-backed loan portfolio being handled, but in most cases, the lender will delay the foreclosure date so the property or properties can be sold by the receiver. During this period, the building’s future becomes uncertain, which should prompt tenants to assess, understand and protect their own commitments.

Tenant Opportunities: Protecting Your Interests

So, if you learn your building is going into receivership, when’s the best time to engage with your landlord? The answer: as early as possible. Proactive communication is key. As a tenant, it is vital to understand your lease terms; however, if it has been a while, now is a good time to dig back in and ensure you understand your rights and obligations, including lease termination clauses, rent payment terms, and provisions regarding building maintenance and repairs. Lines of communication between tenants, the landlord and the appointed receiver are key. The stabilization phase of receivership may provide an opportunity to negotiate as a tenant. As your broker partner, we assist in evaluating the situation and often find an opportunity to reduce occupancy costs while helping the landlord/receiver stabilize the asset.

One essential component in safeguarding tenant interests, especially in this economic environment, is the Subordination Non-Disturbance Agreement (SNDA). This contract involving the tenant and lender ensures that, in the event of receivership or landlord default, tenants are protected from abrupt lease terminations. The SNDA acts as a safety net, preventing banks from rejecting leases without involving the landlord. Having an SNDA in place adds a layer of stability and security for tenants during uncertain times, allowing them to focus on their business operations without the fear of disruptions. An SNDA is not only meaningful for tenants but also benefits landlords, facilitating easier financing negotiations, and lenders, making their loans more secure.

Big Picture: What This Means for the Market

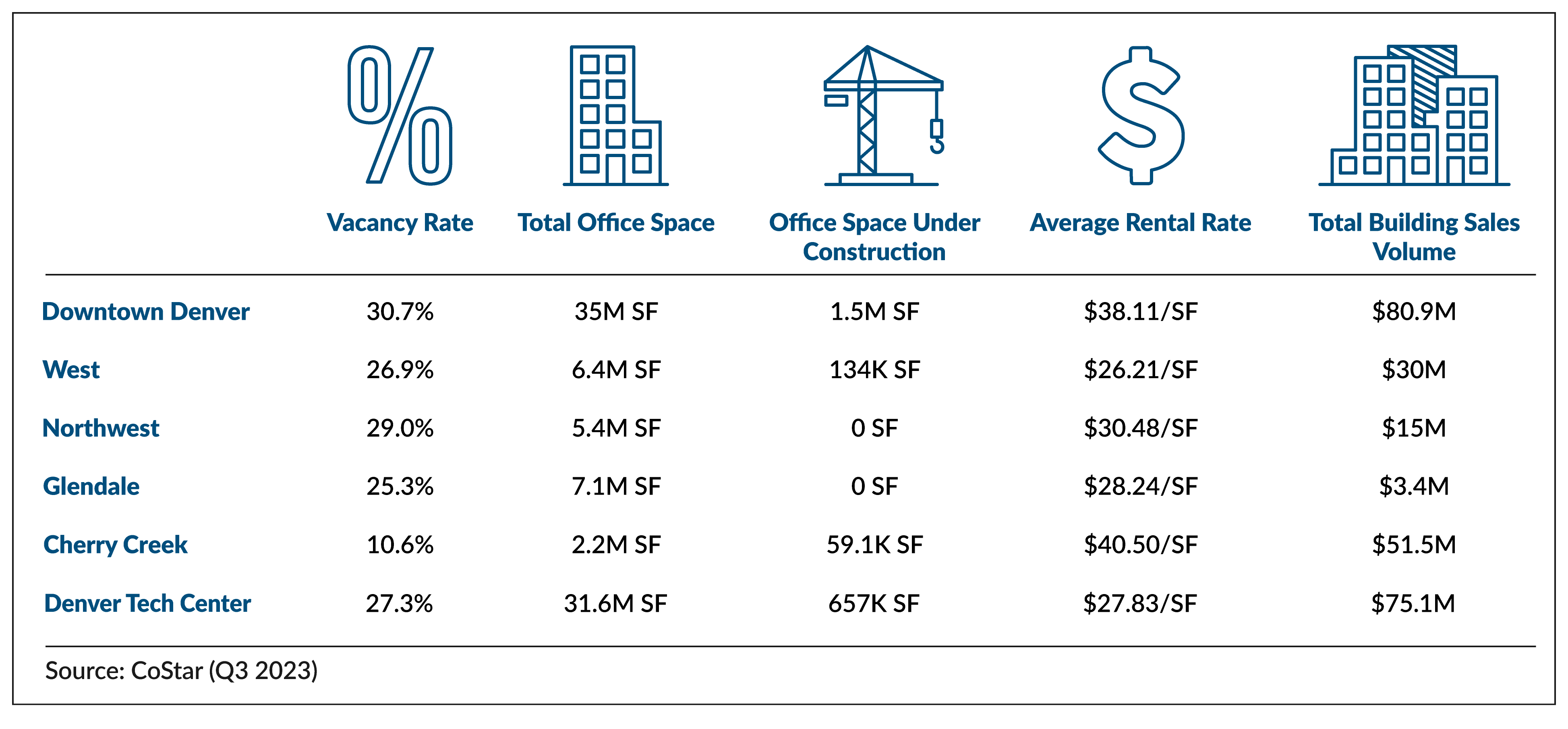

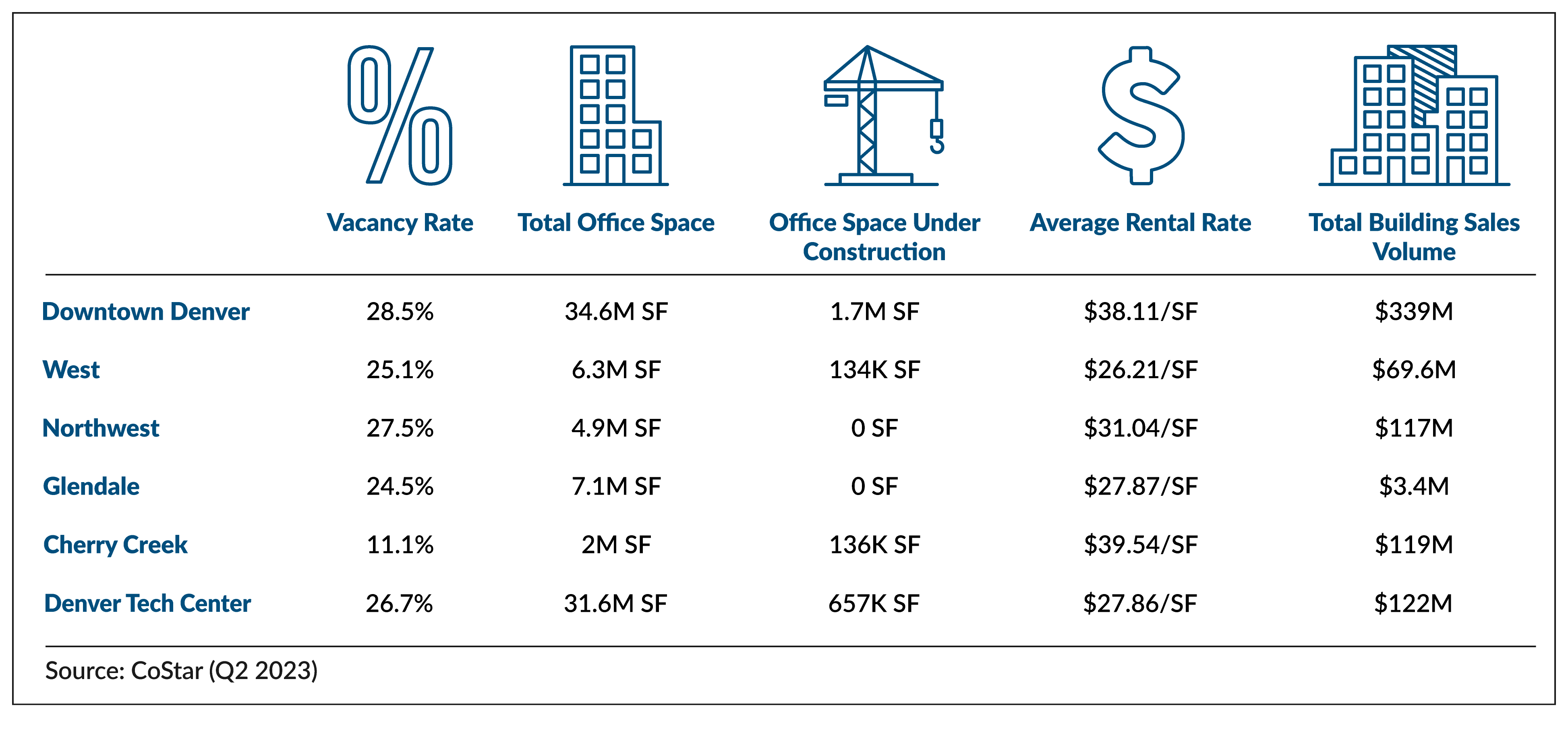

The coming wave of maturities coupled with the falling value of commercial office assets will result in a glut of receivership and landlord default that has far-reaching implications, affecting property values, taxes, commercial mortgage-backed securities and a whole host of other market tendrils. As the coming years unfold, they will bring both challenges, yes, but they will also create opportunities for those who are prepared.

As a result of the market dynamics, the majority of office market portfolio value has vastly diminished. Once a property is ready to be sold by the lender or receiver, it will be at a much lower basis because the equity from the previous owner is wiped out (typically 20-30% of the building’s value) allowing these assets to sell at a lower basis across the market. We will begin to see the impacts as new low watermark prices dictate and rewrite the underlying value of these properties in everything from city budgets to pension fund values.

A property that is already operating as a sunk cost for a current owner is unlikely to be receiving any capital infusions or updates to amenities. This drop-off in investment in the actual spaces will begin to create an even bigger divide between the “haves” and “have-nots” for office tenants, driving demand further toward the well-positioned Class A spaces.

Though there will be considerable market pain associated with this point in time, we will start to see buildings, particularly Class B and C office, become more attractive investments for buyers with imagination. As the floor of property values lowers, savvy investors can transact at a lower cost, disrupting a market that has driven owners, financial institutions and others deep into the spreadsheet without a focus on the tangible value of properties.

Major market shakeups, while extraordinarily difficult for many, do act as a catalyst for innovation. Lower property costs will reengage some of the capital that has been sitting on the sidelines and free up more to be invested back in the repositioning and reimagining of buildings. The office market has been prompting a reevaluation of how space can be utilized and soon, the market will be dictating this evolution.

Regardless of what the next 12 months hold for the building in which your company holds a lease, by remaining informed, proactively engaging with your landlord and safeguarding your interests, you should see this time as an opportunity to leverage your real estate decisions to emerge in a better position for the future.

1According to the Mortgage Bankers Association’s 2023 Commercial Real Estate Survey of Loan Maturity Volumes.